09 February 2024

Financial confidence crisis hits retirees hardest as mortgage repayment pressures add to pensions pain

To visit the Home Advantage hub and read more reports from the study click here

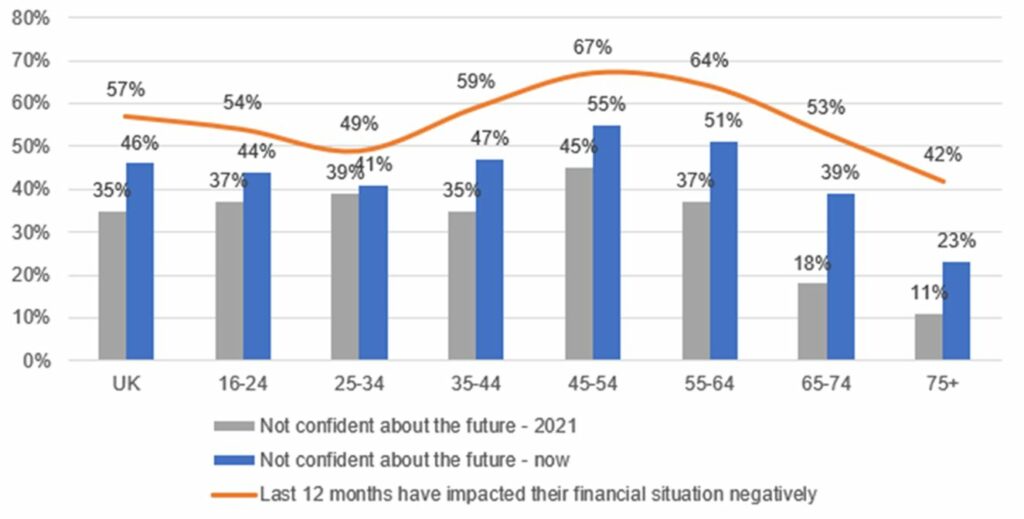

- Study of 5,000 UK adults’ personal finances reveals 46% do not feel confident about their future finances, up from 35% in 2021

- Almost three in five (57%) say their financial situation has got worse in the last year

- People around retirement age (65 to 74 years old) have suffered the greatest loss of confidence with 39% now worried about their future, up from 18% in 2021

- One in five (20%) mortgaged homeowners feel their current loan is “unaffordable”, while 30% have or plan to use pension savings to pay off their mortgage

- Women are significantly more concerned about their retirement prospects and exhausting their pension savings

Nearly half (46%) of people do not feel confident about their finances for the future, a startling increase from 35% in 2021, according to new research by the Equity Release Council (the Council).

The trade association’s biannual Home Advantage study – supported by Canada Life and Equity Release Supermarket – explores 5,000 UK adults’ financial attitudes and experiences, including the role of property as a foundation of financial security.

Building on initial findings from 2021, the latest edition examines how people are coping in the post-pandemic environment of rising interest rates, inflation and economic uncertainty.

It reveals that nearly three in five (57%) UK adults say their financial situation has got worse over the last year, with only 14% feeling their finances have improved.

Loss of financial confidence hits older age groups the hardest

The nation’s loss of confidence has hit older age groups the hardest, as people reassess their retirement prospects in the face of economic and political uncertainty.

People aged 65 to 74 have been the worst impacted. Fewer than one in five (18%) lacked confidence about their future finances in 2021; that percentage has since soared to 39%.

The 55 to 64 age group and those aged 75 and over have also experienced a more drastic loss of confidence since 2021, compared with the national average. The percentage of adults aged 55 to 64 who are lacking confidence about their future finances has jumped from 37% to 51%, while almost one in four people aged 75 and over feel the same (23%), up from 11%.

Graph 1: Financial impact of the last year and confidence about their future finances

The findings follow new analysis from the Pensions and Lifetime Savings Association (PLSA), which shows the rising cost of living and an expectation to offer financial support to grandchildren have pushed up the income needed for a moderate standard of living in retirement by £8,000 over the last year.

Mortgage repayment pressures likely to add to pensions pain

The Council’s study explores people’s personal finance pressure points, at a time when the 5.25% base rate means many homeowners face significantly higher costs than when they last remortgaged.

Its findings reveal that one in five (20%) of the UK’s 8.5m² mortgaged homeowners say they find their current loan “unaffordable”, equivalent to 1.7m households.

Almost one in three (30%) say they already have or plan to use some of their pension savings to pay off their mortgage. Single homeowners are even more likely to do so (33%).

These mortgage pressures risk adding to people’s savings shortfalls in later life, with many already concerned they won’t be able to afford a comfortable retirement.

More than one in three homeowners (37%) say they have struggled to build up enough pension savings to be confident about their living standards in retirement. Similarly, 41% are worried about using up their pension savings too quickly.

In both cases, women are grappling with more widespread concerns: 44% are worried about their pensions being used up too quickly (vs. 39% of men) while 40% have struggled to build up enough savings to feel confident about retirement (vs. 35% of men). New figures published this week by NOW: Pensions in its Gender Pensions Gap report show that women typically retire on average with pension savings of £69,000, compared to £205,000 for men.

Government data shows property is UK households’ second biggest asset¹, with property and private pensions together accounting for more than three-quarters of total household wealth.

Jim Boyd, Chief Executive Officer, Equity Release Council, comments:

“The deterioration of confidence in our future finances since the Covid pandemic is shocking, particularly among those about to retire. More people are having to make hard choices which will potentially have a long-term impact on their financial security.

“Mortgage repayment pressures mean many households are planning to use their pensions to pay off mortgage debt, possibly at the expense of a comfortable retirement. While others are struggling to pay these higher mortgage costs during their working lives which is limiting the amount they can save into their pension. Although many hope to retire debt-free with a healthy pension pot, we mustn’t forget the millions who can’t save or pay down their mortgages and encourage them to consider all their options including property wealth.

“I am concerned that homeowners and their families might be struggling to get by when the wealth locked up in their properties could fund far better lives in retirement. Anyone lucky enough to own a home should give careful thought to how lifetime and later life mortgages can support their finances, and not overlook options that are literally on their doorstep.”

Tom Evans, MD of Retirement, Canada Life, comments:

“It’s understandable why confidence levels around finances have taken a huge knock over the past few years. Many people will have mapped out their retirement, but thanks to higher living costs, including increased mortgage repayments, those plans may well have gone out the window. In fact, our own data shows that paying off an existing mortgage was the top reason for releasing equity last year.

“Whilst home ownership can provide some kind of cushion and financial security, having to pay off a mortgage with funds from a pension means being caught between a rock and a hard place; balancing the tricky act of clearing debts today and securing income for retirement in the future.

“It’s important that those yet to make plans for their retirement, start doing so sooner rather than later. As the current economic environment shows having contingency plans in place is vital.

“Having to plan alone might feel very isolating. It’s worth remembering that there are many resources including financial guidance, while an independent financial adviser can help you understand all your options and support you with planning holistically for your retirement.”

Mark Gregory, Founder & CEO at Equity Release Supermarket, comments:

“More homeowners approaching the age of 55 are increasingly considering equity release, in part due to the higher costs of living and the need to release equity tied up within the household to facilitate this. Yet, approximately 1 in 4 people still believe that equity release should be treated as a last resort. However, this is mainly derived from a general lack of understanding, limited knowledge of mortgages available in later life and information around equity release products across the market, as opposed to the opportunity it presents.

“With tools now available such as smartER™ consumers can gain a vast amount of information, as well as real-time deals that match their personalised circumstances so that they can understand their individual scenario. Providing this live data enables consumers to take control, understand how much they can release and have the flexibility to research options in their own time before speaking to an Adviser.

“We understand the value this holds with consumers, given that there has been a sharp rise in the amount of people now using online tools for research purposes. We believe acceleration is down to trust, accuracy, and reliability. We know that consumers feel more comfortable having the information literally available at their fingertips and the ability to engage in product comparison sites prior to making a financial decision. Hence, equity release is no different. Passing initial control to the consumer, similarly to the mortgage market, will allow for greater consumer confidence and independence within the sector.”

ENDS

Notes to Editors

1 Household total wealth in Great Britain: April 2018 to March 2020, latest release 7 January 2022

https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/…

² UK Finance data in June 2023, https://www.ukfinance.org.uk/news-and-insight/press-release/uk-finance-mortgage-data

All findings come from independent research carried out by Censuswide among 5,000 nationally representative UK adults aged 18+ in June 2021 and November 2023. Combined with analysis of government, regulatory and industry data, Home Advantage represents the Council’s biggest study to date of consumer attitudes and behaviours in relation to their personal finances and property wealth. The 2023 edition of the research is supported by Canada Life and Equity Release Supermarket.

For more information:

Visit www.equityreleasecouncil.com

Email Instinctif Partners at [email protected]

Phone Libby Wallis, Andy Lane and Mike Norris on +44 (0) 207 457 2020

About the Equity Release Council

The Equity Release Council (the Council) is the representative trade body for the UK equity release sector with more than 750 member firms and 1,800 individuals registered, including providers, funders, regulated financial advisers, solicitors, surveyors and other professionals.

It leads a consumer-focused UK based equity release market by setting authoritative standards and safeguards for the trusted provision of advice and products. Since 1991, more than 650,000 homeowners have accessed £46bn of property wealth via Council members to support their finances.

The Council also works with government, voluntary and public sectors, and regulatory, consumer and professional bodies to inform and influence debate about the use of housing wealth in later life and retirement planning.

About Equity Release Supermarket:

Equity Release Supermarket was founded by Mark Gregory in 2008, and has grown to become the UK’s No.1 independent equity release advisory service, having helped thousands of people to enjoy financial freedom through equity release. They’ve built their reputation on the premise of outstanding financial advice.

Mark was an equity release adviser and so he understands both the customer journey and how equity release can help change people’s lives. His vision was one where he could offer his customers the very best impartial financial advice, access plans from the whole marketplace, recommend the best equity release deals, and make the most of technology to help his customers.

Equity Release Supermarket have a 100% Trusted Merchant Status from independent review service Feefo and are regulated directly by the Financial Conduct Authority (FCA) No. 584063. They are also members of the Equity Release Council, who set the standards for the industry.

For more information, please visit: https://www.equityreleasesupermarket.com

For more information about smartER, please visit: https://www.equityreleasesupermarket.com/smarter-equity-release-search