11 March 2024

2.8 million people find mortgages stopping them saving more for later life

To visit the Home Advantage hub and read more reports from the study click here

- Debt burden stopping 18% of mortgaged over-55s from saving more for retirement, 10% from reducing their work hours and 16% from retiring completely

- One in five (20%) do not expect to retire mortgage-free, while 19% more are unsure

- Almost one in three (31%) UK consumers believe accessing their property wealth could improve their finances in retirement, up from 25% in 2021

- More than one in four (26%) believe a later life mortgage could be a useful way to boost their income in retirement, up from 21% in 2021

Almost one in four (22%) UK homeowners with a mortgage – equivalent to 2.8 million people – say repayments are stopping them from saving more for retirement, according to new findings from the Equity Release Council (the Council) and Canada Life.

This figure has spiked since 2021, when only 14% said the same. It includes more than half a million (515,067) homeowners who are still paying a mortgage beyond the age of 55.

Almost one in six (16%) of this older group say the burden of mortgage debt is holding them back from retiring completely, up from 14% in 2021. One in ten (10%) say their loan is stopping them from reducing their hours at work, more than double the number impacted in 2021 (4%).

The findings come from the Council’s Home Advantage study of 5,000 UK adults’ financial attitudes and experiences. The data shows how the strain of managing their mortgages – which often involve larger sums and longer terms than previous generations – is having a major impact on people’s wellbeing and financial plans, exacerbated by higher interest rates.

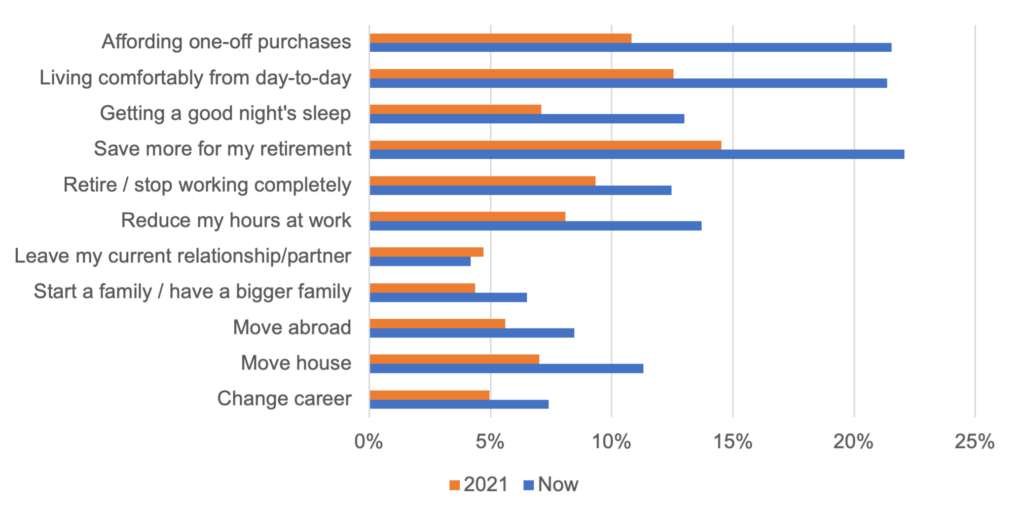

Among all UK homeowners with a mortgage, 21% say their current mortgage debt is preventing them from affording a comfortable lifestyle from day-to-day, up from 13% in 2021.

Mortgage worries are also keeping 13% of people awake at night, preventing 11% from moving house and prompting 7% to pause family plans.

Graph 1: Short and long-term actions negatively impacted by managing mortgage debt

Source: Equity Release Council and Canada Life, %s are for all UK homeowners with a mortgage

Is mortgage freedom becoming a luxury in later life?

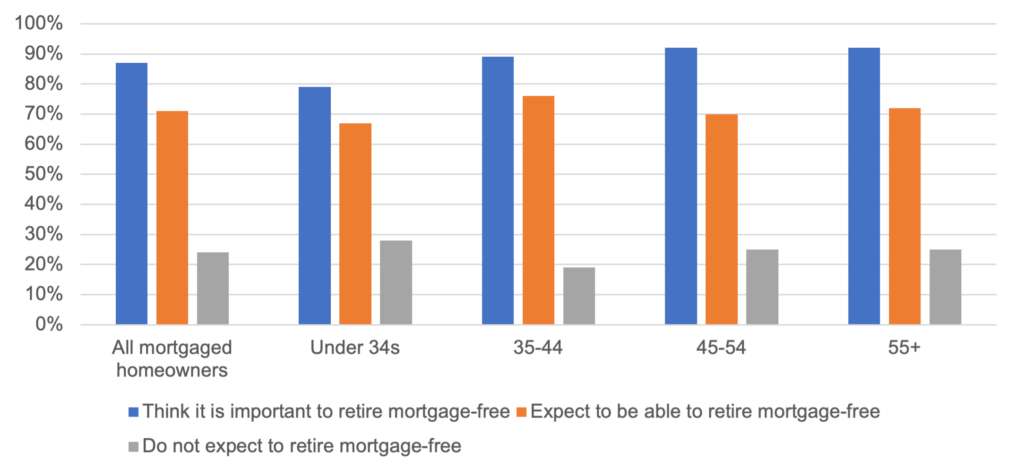

The study, supported by Canada Life study, shows that, overwhelmingly, 90% of homeowners think it’s important to be mortgage-free by the time they retire.

However, the reality is likely to be very different with only two thirds (66%) of those with mortgages believing they will clear them before they retire, and just 60% of those aged 55 and over. Younger generations of mortgaged homeowners are also less likely to feel that it’s important to retire mortgage-free.

Among those aged 55 and over, one in five (20%) mortgaged homeowners – equivalent to 572,297 people – do not expect to retire mortgage-free, while another 19% are not sure.

Graph 2: Who wants a mortgage-free retirement and who can achieve one?

Growing appetite for later life mortgages

The changing landscape is prompting more homeowners to bank on their property wealth and later life mortgages to help manage their money as they grow older.

Almost one in three (31%) UK consumers believe accessing property wealth in later life can improve their finances and boost their retirement income: a significant rise from 25% in 2021.

More than one in four (26%) now believe a later life mortgage could be a useful way to boost retirement income, an increase of five percentage points since 2021 when 21% felt this way.

Over the last five years (2019-2023) over-55s have taken out 201,575 new equity release plans to support their later life finances. These products allow homeowners to access the wealth tied up in their property following a regulated financial advice process and with additional safeguards provided by the Council.

This level of activity represents a 30% rise compared with the previous five years, when 155,082 new plans were taken out between 2014-2018.

Jim Boyd, CEO of the Equity Release Council, comments:

“With higher interest rates leading many people’s monthly mortgage payments to rise, this harsh reality is making it difficult for homeowners to prioritise retirement savings alongside their mortgage and wider bills.

“While this might be something they can just about manage in the short term, the real concern of this spike in mortgage costs is the strain it puts on people’s long-term financial resilience. It’s truly alarming that mortgage debt has become so uncomfortable that people are having to putting off starting a family, ending a relationship, or changing career. Having to push back key milestones and life moments like this is not only disheartening but could ultimately be detrimental to society as a whole.

“Rather than struggle against the tide, we need to recognise we are in a new era where the goal of becoming mortgage free will, for some people, be less important than the practical need to access property wealth in later life. With approximately £2.63 trillion of net housing wealth in homes owned by people aged 65 or over, there are clear signs that a shift in the national conscience is underway and property wealth is stepping into the spotlight for retirement planning conversations.”

Tom Evans, MD Retirement, Canada Life, comments:

“Retirement feels like a distant dream for many, and having worked hard throughout life, it’s logical to hope or even expect to be mortgage free when reaching this milestone. As the past few years has shown us though, unexpected changes can happen, with plans getting turned on their head. As such, many of us will face the possibility of having to adjust our ways of living in retirement.

“Whilst this may feel unsettling, it’s important to remember that there are always options. Lifetime mortgages now offer greater flexibility to individual needs, and so more people may consider the prospect of using property wealth alongside other assets to fund retirement. Our customer data shows that paying off an existing mortgage has been the top reason for releasing equity for the past six years, but this is just one of many drivers for customers releasing value from their homes.

“For those considering releasing equity, it’s important to do lots of research discuss it with your family first and then engage with a professional financial adviser.”

Lifetime mortgages, the most common form of equity release, are loans for people over 55 that are usually repaid when the customer dies or goes into long-term care.

The Equity Release Council is the representative trade body for the UK equity release sector. It sets industry standards and safeguards, such as a no negative equity guarantee and the right to penalty-free repayments, enabling customers to manage their loans.

ENDS

Notes to Editors

All findings come from independent research carried out by Censuswide among 5,000 nationally representative UK adults aged 18+ in June 2021 and November 2023. Combined with analysis of government, regulatory and industry data, Home Advantage represents the Council’s biggest study to date of consumer attitudes and behaviours in relation to their personal finances and property wealth. The 2023 edition of the research is supported by Canada Life and Equity Release Supermarket.

About the Equity Release Council

The Equity Release Council (the Council) is the representative trade body for the UK equity release sector with more than 750 member firms and 1,800 individuals registered, including providers, funders, regulated financial advisers, solicitors, surveyors and other professionals.

It leads a consumer-focused UK based equity release market by setting authoritative standards and safeguards for the trusted provision of advice and products. Since 1991, more than 650,000 homeowners have accessed £46bn of property wealth via Council members to support their finances.

The Council also works with government, voluntary and public sectors, and regulatory, consumer and professional bodies to inform and influence debate about the use of housing wealth in later life and retirement planning.

About Canada Life

Canada Life is part of a group of companies controlled by Great-West Lifeco Inc., a diversified financial services holding company headquartered in Winnipeg, Canada. Through its subsidiary companies, Great-West Lifeco has operations in Canada, the United States, and Europe. Great-West Lifeco and its insurance subsidiaries have received strong ratings from major rating agencies. Great-West Lifeco has over 38 million customers worldwide and £1.532trillion assets under administration (as at 31 December 2022).

Canada Life Limited began operations in the United Kingdom in 1903 and looks after the retirement, investment and protection needs of individuals and companies alike. As well as providing stability and security through its individual contracts, Canada Life Limited has grown and maintained its position as the market leading provider of group insurance solutions.1 Canada Life acquired Retirement Advantage on 3rd January 2018 for an undisclosed sum. The acquisition added over 30,000 retirement income and equity release customers and more than £2 billion of assets under management including a £1.5 billion block of in-force annuities to Canada Life.

Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Canada Life International Limited and CLI Institutional Limited are Isle of Man registered companies authorised and regulated by the Isle of Man Financial Services Authority. Canada Life International Assurance Limited and Canada Life International Assurance (Ireland) DAC are authorised and regulated by the Central Bank of Ireland.

Stonehaven UK Limited, registered in England and Wales no. 05487702. Registered office: Canada Life Place, Potters Bar, Hertfordshire EN6 5BA.

Stonehaven UK Limited is authorised and regulated by the Financial Conduct Authority.

- Canada Life MI & Swiss Re, 2022

For more information:

Visit www.equityreleasecouncil.com

Email Instinctif Partners at [email protected]

Phone Libby Wallis, Andy Lane and Mike Norris on +44 (0) 207 457 2020