The landscape for the Equity Release market is evolving, in part driven by demographic shifts. With fewer births and longer lifespans, the population is aging, and by 2050, one in four people will be over 65 years old.

Often, we talk about these changing demographics solely as an opportunity for growth. Another consequence is longer lives, and longer policies, which means customer interactions with more customers in their 80s, 90s and 100s.

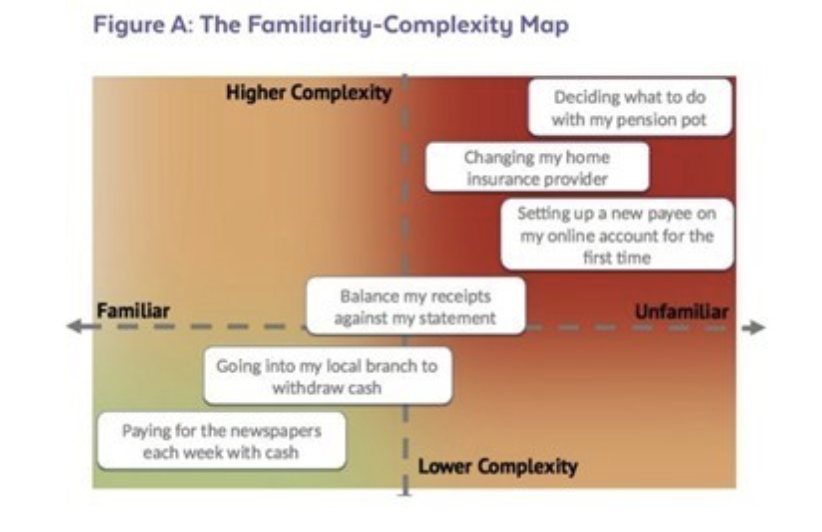

The FCA’s research on the Aging Mind, delivered by the Big Window, looks at the “familiarity/complexity” map. This shows that as we age, and feel the impacts of cognitive decline, the green quadrant (what was previously simple and familiar) gets smaller, and the red gets larger. This is important for Later Life Lenders, and Advisers, to consider – how can we continue to design and deliver good outcomes for all customers, knowing their needs will change over time?

What does good practice for vulnerable customers look like in the Later Life Lending Summit?

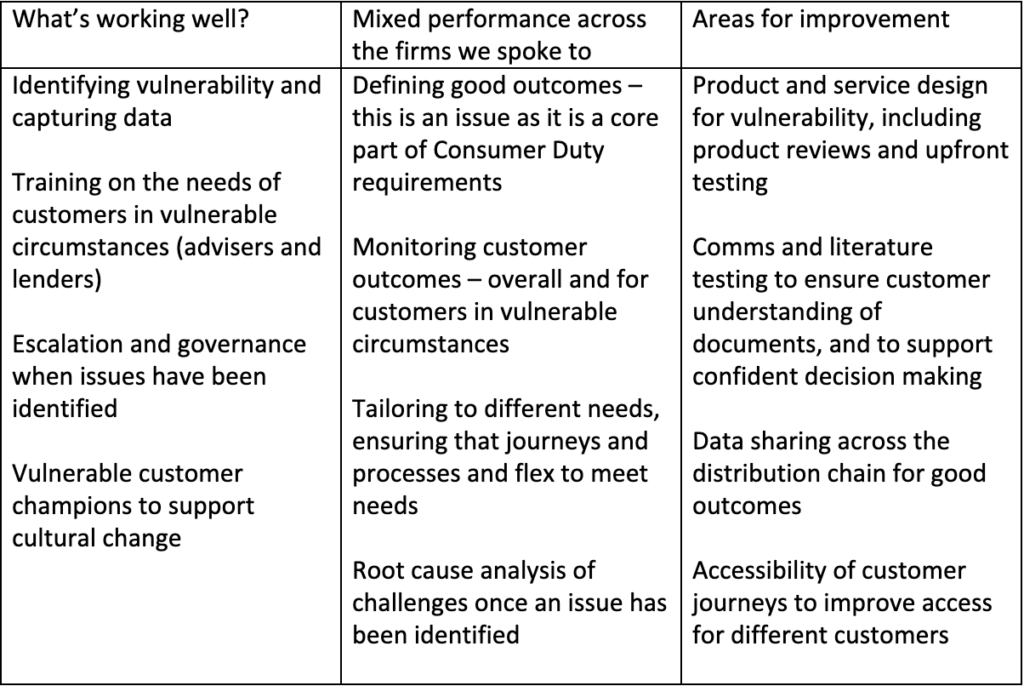

In March 2025, the FCA released a review of the treatment of customers in financially vulnerable circumstances2. The review highlighted some areas of good practice, but many more areas to improve.

As part of our work with Equity Release Council, we wanted to understand what good practice looks like, and what areas of improvement there are, specifically for the Later Life lending sector. We spoke to 10 member firms, and asked members to complete a survey, about their experiences with customers in vulnerable circumstances and their own approaches to delivering good outcomes for all customers.

This identified core themes of what’s working well, and areas for improvement, across the firms we spoke to:

We’re working with the Council to release a discussion paper this summer that provides case studies on different areas of the Consumer Duty and treatment of vulnerable customers. By providing specific case studies for advisers and lenders, we hope to bring these practices to life to design and deliver better outcomes for more customers, now and in the future.