12 May 2025

Unlocking property wealth for retirement could inject £21bn each year into UK economy by 2040

- Half of UK households (51%) expected to require housing wealth to fund their desired later life living standards

- £23 billion forecast to be unlocked from property wealth each year by 2040

- Fairer Finance sets out five recommendations to Government and regulators to break down barriers including advice reform

Half of UK households (51%) are expected to require housing wealth to support their spending needs in later life and retirement – unlocking over £23 billion, in today’s prices, each year by 2040 – according to new modelling1 by Fairer Finance. The independent consumer group also forecasts that this shift could deliver a £21 billion boost to the UK economy each year.

Based on levels of pensions and savings alone, almost four in ten (38%) future retirees are heading for an income below the recommended minimum living standard2. Yet, on average people in the UK hold more housing wealth than pension wealth3, highlighting a major mismatch between resources and retirement funding strategies.

Report calls for urgent action to break down barriers:

Fairer Finance’s report [How can housing wealth bridge the later life funding gap? | Fairer Finance] calls for urgent action from Government and the Financial Conduct Authority (FCA) to break down the barriers that prevent older homeowners from accessing the equity in their homes, and to integrate housing wealth into mainstream retirement planning alongside pensions.

The report was commissioned by the Equity Release Council. However, Fairer Finance retained full editorial control. As well as considering how later life lending can support more consumers in retirement, it also considers the barriers to unlocking housing wealth through downsizing.

New economic modelling unveiled:

New economic modelling within the report shows the scale of the problem and considers how housing wealth can be part of closing the gap.

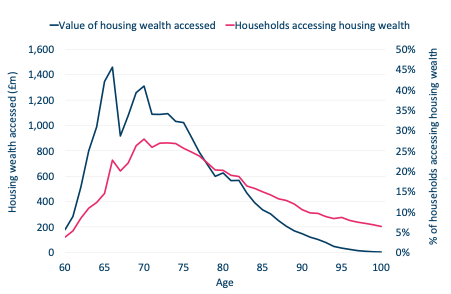

Figure 1 below illustrates how people might access their housing wealth to maintain their living standards in 2040. The first peak, at age 65, reflects the initial need for income before people receive the state pension. The second peak is partly driven by some people repaying their residential mortgage in their late 60s. Some people in their 70s, 80s and 90s experience care-related cost shocks, which increases their need for income and therefore usage of their housing wealth.

Figure 1: The value of housing wealth accessed, and the proportion of households accessing housing wealth by age:

Note: 2025 prices. / Source: Fairer Finance.

Report suggests five important policy recommendations:

The report – ‘How can housing wealth bridge the later life funding gap?’– makes five recommendations to regulators and government:

- Increase housing supply: Build more suitable and desirable homes for downsizing located in the communities where people in later life wish to live.

- Reduce stamp duty: Cut stamp duty for older people downsizing to encourage mobility and free up larger homes.

- Normalise the use of housing wealth to maintain living standards in later life: MoneyHelper and Pension Wise should embed housing wealth as a central part of later life advice and guidance. Government and public agencies should invest in public information campaigns to break down the stigma and normalise the use of housing wealth in retirement.

- Create a single financial view: Government and regulators should develop a personalised service for consumers to see their pension and housing wealth in one place.

- Reform financial advice: The report calls for the FCA to reform the regulation around later life advice, to break down advice silos and ensure all consumers are supported to maximise the use of all their assets as they approach retirement.

On point five specifically, the FCA should:

- Ensure that equity release advisers are obliged to consider all forms of later life lending.

- Build more explicit consideration of housing wealth into the FCA rulebook, such that financial advisers assess the role that housing wealth may play for customers in funding their retirement.

- Ensure that advice on mainstream mortgages to people from the age of 50 onwards explicitly considers retirement planning, including later life lending options. This may be through referring people to retirement dashboards, midlife MOTs, or other professional advisers which bring together all sources of retirement wealth.

- Allow for targeted support to assist consumers in considering their use of housing wealth as they plan for retirement (whilst ensuring that equity release remains an advised sale).

- Use the levers of the Consumer Duty to ensure the UK has a vibrant and competitive later life lending market, which offers fair value to consumers and creates the conditions for product innovation. In advice markets, the FCA should use the Consumer Duty to eliminate product bias – and ensure that consumers are supported to achieve the best outcomes for their needs, regardless of which part of the advice market they are engaging with.

James Daley, Managing Director at the independent consumer group Fairer Finance, commented: “It’s an inevitability that more people will need to rely on their housing wealth in retirement – and our new research shows the scale of the problem as well as the opportunity. The combination of smaller pensions, increased longevity and rising care costs threaten to create a perfect storm which will leave millions of people unable to maintain their living standards in later life.

“But with around 75% of the population owning a property as they reach retirement, many people are sitting on – and sleeping in – a significant store of wealth. As things stand, there are a number of social, economic and regulatory barriers which stop housing being part of the mainstream retirement planning conversation. For those who want to downsize, there is a lack of suitable and desirable retirement housing. Whilst when it comes to borrowing in later life, the silos in regulated advice markets mean many people are not being presented with all their options. If we’re to head off a later life funding crisis, policymakers need to start taking action to bring down these barriers now.”

Other points to note from the report include:

- In today’s prices, £23bn of housing wealth could be accessed each year, to reach higher living standards. The annual withdrawal would be approximately 0.5% of total housing wealth for those aged 60+.

- The gross value added (GVA) of this spending is worth £21bn to the UK economy (in today’s prices). This would represent approximately 0.7% of total UK GDP in 2040

- 51% of households might access housing wealth to reach their desired living standards during later life. 18% of households aged 60+ might access their housing wealth in 2040.

- Of those that do access housing wealth, the median total amount taken over their lifetime is estimated to be £140,000 (in today’s prices).

[TRADE QUOTE]

Jim Boyd, Chief Executive, Equity Release Council, the representative trade body for the UK equity release market, commented: “Fairer Finance forecasts property wealth taken in the form of later life lending could inject £21 billion into our economy each year from 2040. This substantial amount has the potential to act as a real economic stimulus supporting businesses and improving the living standards and spending power of our rapidly ageing population. 45,000 UK jobs are already directly funded through money released from bricks and mortar – the growth of later life lending can potentially take this to another level.

“Whether an older person speaks to an equity release adviser, a mortgage adviser or a financial adviser, how they want or need to use their housing equity should be part of the conversation. Today’s report challenges us to develop a system that treats housing wealth as a core part of retirement planning, removes regulatory barriers and gives people the confidence to use it wisely.”

[CONSUMER QUOTE]

Jim Boyd, Chief Executive, Equity Release Council, the representative trade body for the UK equity release market, commented: “Fairer Finance forecasts property wealth taken in the form of later life lending could inject £21 billion into our economy each year from 2040. This substantial amount has the potential to act as a real economic stimulus supporting businesses and improving the living standards and spending power of our rapidly ageing population. 45,000 UK jobs are already directly funded through money released from bricks and mortar – the growth of later life lending can potentially take this to another level.

“We know younger homeowners are interested in using money in their homes in later life to meet a range of financial needs as generous final salary pensions all but disappear. Today’s report challenges us to develop a system that treats housing wealth as a core part of retirement planning, removes regulatory barriers and gives people the confidence to use it wisely.”

For more information on Fairer Finance and to read the report in full, please visit www.fairerfinance.com.

Notes to editors

For further information, please contact:

Karen Mignon, KM Comms: [email protected] / +44 7766 651327

Louise Ahuja, KM Comms: [email protected]/ +44 7788 676913

1 Fairer Finance has modelled the way in which housing wealth can be used to increase living standards in later life. However, this is not a forecast. Rather, we estimate the size of the opportunity if policymakers, regulators, and industry can overcome the barriers that stand in the way of people accessing the value of their home through lifetime mortgages.

The model looks forward to 2040. The model estimates the difference between desired spending and household income in 2040, for the population aged 60 and above. Where the desired spending is greater than the household income, we model the potential impact of people accessing the value of their home through a lifetime mortgage.

We have not modelled the way in which people make the trade-off between their standard of living and their ability to give an inheritance. Some people are likely to choose to accept a lower quality of life, to preserve some (or all) of the value of their home as inheritance. We also do not model the potential for a growth in downsizing to meet consumers’ needs. We have instead focused on the potential role of later life lending in meeting spending needs, whilst acknowledging that people may choose other options.

The modelling suggests that the UK population of people aged 60 and above would access approximately £23bn of housing wealth each year, in 2025 prices. This figure is based on the modelled population in 2040 (adjusted for inflation), and considers only meeting the spending needs defined in the model. Therefore, this figure does not consider the use of housing wealth to meet other needs, such as giving inheritance at a time of the consumer’s choosing.

The housing wealth of those aged 60 is modelled to be approximately £4,300 billion in 2040, so the annual withdrawal would be approximately 0.5% of total housing wealth.

Without this spending, these households would have a lower standard of living. For some households, this might also mean that they claim more means-tested benefits.

Based on the modelling, we estimate that by the age of 90, some 51% of households would have accessed housing wealth to meet spending needs at some point since the age of 60. Our modelling for the year 2040 suggests that approximately 18% of households aged 60+ might access their housing wealth in that year.

Based on the aggregate spending of £23bn enabled by individuals accessing their housing wealth, we estimate that the GVA contribution of this spending. We base this estimate on typical spending patterns of those aged 60 and over. The direct GVA would be some £12bn, with an additional indirect GVA contribution of £9bn. The sum GVA impact of £21bn would represent approximately 0.7% of total UK GDP in 2040.

The report has been developed using 9,720 different household scenarios designed to represent the range of outcomes we might expect for 75% of the whole population aged 60 and above. These outcomes are aggregated – using suitable weightings based on available statistics – to provide UK-wide totals

2 Scottish Widows (2024), ‘Retirement Report 2024’.

3 Office for National Statistics (2025), ‘Household total wealth in Great Britain: April 2020 to March 2022’.

About Fairer Finance

Fairer Finance is an independent consumer group and ratings provider whose mission is to help create a financial services market that is fair for consumers as well as the companies that serve them. With a heritage spanning over a decade, we regularly engage with regulators, government, and industry bodies helping to influence and shape new pieces of legislation and regulation. Our independent economic impact studies inform evidence-based policy.

About the Equity Release Council

The Council is the representative trade body for the UK equity release market. Plans that meet the Council’s standards come with six product safeguards: no negative equity guarantee; fixed or capped rates for life; the right to port; the right to make overpayments; no early repayment charge if you move into care provided a medical certificate is provided and secure tenure for life. These safeguards are underpinned by mandatory independent legal advice which ensures the customer understands the risks and implications of the plan.

It leads a consumer-focused UK based equity release market by setting authoritative standards and safeguards for the trusted provision of advice and products. Since 1991, over 688,000 homeowners have accessed £50bn of property wealth via Council members to support their finances.