29 January 2022

The market in the pandemic: expectations vs reality

The Council has issued its final year market data for 2021 and it’s nowhere near as bad as the pre-pandemic predictions, writes its communications manager Chris Fay.

The pandemic was scary. It still is and it has not left us. As we learn to live with covid, fears for our health and that of our loved-ones may have downgraded themselves to concerns, but that concern is real.

When the first lockdown was imminent, some of the predictions for the market were almost as scary. Experts were predicting meltdown, but it would be unfair to single them out now, with the benefit of hindsight. All I will say is these were proper experts and not merely commentators and (ex) journalists like me.

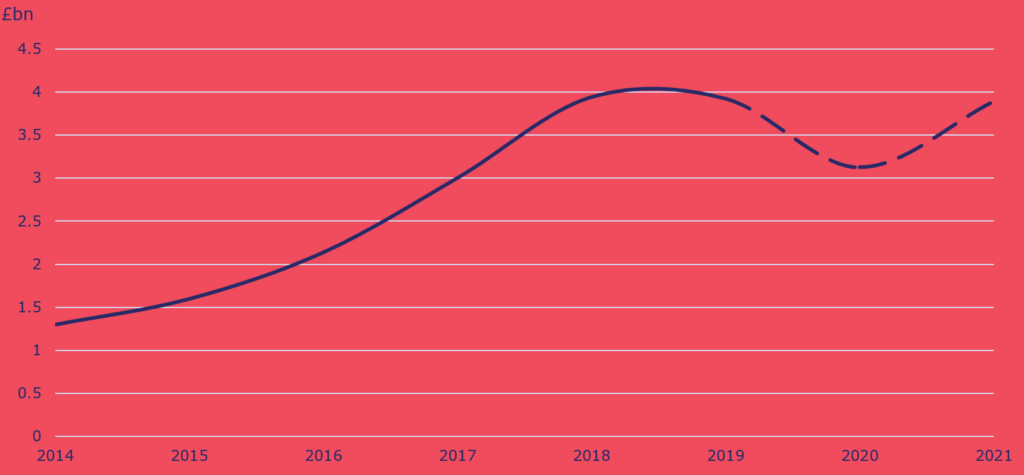

Back in Q1 2019, here’s what we thought we were facing:

I want to fast forward to Q1 2022 but it would be trite of me to do so without acknowledging the efforts of our health professionals and the human toll of covid. A toll not just on those who have been unwell and even died but on students who missed exams; couples that couldn’t marry; firms that couldn’t trade; and of course mourners excluded from funerals.

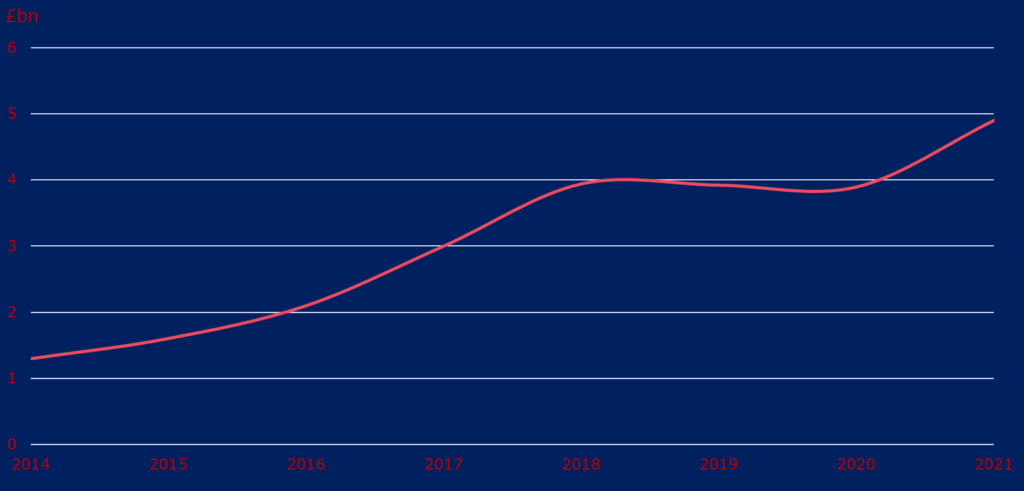

When those 2021 figures eventually rolled in, what we saw was thankfully very different to the predictions. We had experienced what I like to call the diplodocus of growth – simply because the graph below looks like the outline of a dinosaur to me.

So what does the graph tell us? Clearly it shows the market was far more robust than predicted and consumers remained confident in the products. Products that are underpinned by the Council’s standards and safeguards.

It shows that the drivers for growth remain in place – socio economic factors, product innovation and again those all-important Council standards. And it shows the sector is back on the same trajectory it was on before the uncertainty around Corbyn Vs May and hard Brexit Vs soft.

In terms of numbers total lending reached £4.8bn in 2021 among 74,000 new and returning customers, a 24% rise from £3.86bn in 2022. New customers taking drawdown plans increased their total borrowing by 18% in Q4 2021 compared with Q4 2020.

The reasons for taking out equity release have not changed but cost of living pressures may have exacerbated the situation for those seeking to meet daily living expenses. House price growth may have been behind the greater loan sizes we have seen and the race for space, driven by lockdown, most likely fuelled gifting to help loved-ones onto the property ladder.

That tells us we can be incredibly proud of our industry for being able to support people during what was and of course still is, a troubling time.

- To read the market data in full, click here.