26 May 2022

The Equity Economy report – what it reveals about the impact of equity release on the UK economy

Craig Brown, CEO of Legal & General Home Finance, shares this thought-provoking blog on the Equity Economy, particularly the wider impacts on the economy.

We’re all well-aware of the benefits lifetime mortgages can bring to individual customers, but what about the wider impacts of our industry on the economy?

We’ve been working with the Centre for Economics and Business Research (Cebr) on a wide-ranging study, called The Equity Economy. The full report, which we’ll be publishing shortly, is based on desk-based research, alongside economic modelling and forecasting, underpinned by a survey carried out with 2,000 homeowners, including more than 300 equity release customers.

Our initial findings released this week show cash accessed by equity release has supported nearly £3.8 billion in UK gross value added (GVA).

We can see that, with the property market continuing to boom, the value held in the homes of the UK over 55s is both significant and growing. Complimenting this, over the past decade, the later-life lending market has seen improved standards and advice, and growth in flexible products to meet customer need; giving homeowners confidence and security in making use of this asset.

Our research demonstrates that a growing number of people will look to their property wealth to fund their lifestyle, particularly in retirement.

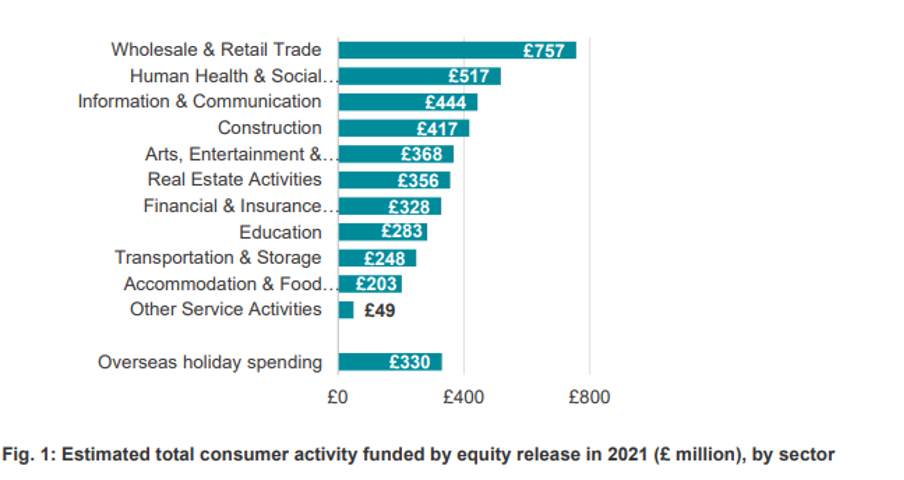

The finds show that money previously tied up in bricks and mortar was spent across a range of sectors as homeowners supported family members, achieved their goals and boosted their incomes with the extra funding. The wholesale and retail sector benefitted most from the extra cash unlocked (18% – £757 million). A significant share of the equity release funds was also spent on the health and social work sector (12% – £517 million), likely due to the significant care spend of this age group.

Through its contribution to the UK economy, equity release spending by homeowners also supports job creation in a range of sectors across the country. Spending funded directly by equity release generated more than 45,000 jobs. A third of this total, equating to 15,300 roles, are found in the health and social work sector, due to the high spend on care costs. Taking into account the indirect supply chain effects, and induced effects of this spending, modelling was undertaken by Cebr estimates that an additional 35,000 jobs are supported as a result of equity release’s impact on the economy.

Our report demonstrates that the impact of the equity release market is more significant than just the spending power it gives to the individual homeowner: it funds businesses, creates jobs and makes a positive contribution to the UK economy. I look forward to sharing our full report with you.